Global Broadband Subscribers in Q1 2025: FWA, Satellite, and Consolidation Pressures

- Jolanta Stanke

- Jul 31, 2025

- 8 min read

Summary

This report provides analysis of trends in global and regional broadband subscriptions, technology adoption, and growth rates in major markets in Q1 2025.

Global broadband subscribers surpassed 1.52 billion in Q1 2025, marking a 1.21% growth, with South and East Asia leading the expansion. Broadband subscriptions[1] declined in 22 countries[2], up from 14 in Q4 2024. In some of these markets consumers prefer to use mobile broadband, others are experiencing economic headwinds or are already highly saturated. Some are still in the midst of conflict (Israel, Palestine, Sudan). Globally, the growth in Q1 2025 has recovered, compared to the previous quarter.

Other key points:

In terms of growth, India remained at the top of the largest 20 fixed broadband markets with a 4.7% quarterly growth rate.

The share of FTTH/B in the total fixed broadband subscriptions increased further and stood at 72.34%. Broadband connections based on other technologies saw their market shares shrink again, with an exception of satellite and fixed wireless access (FWA).

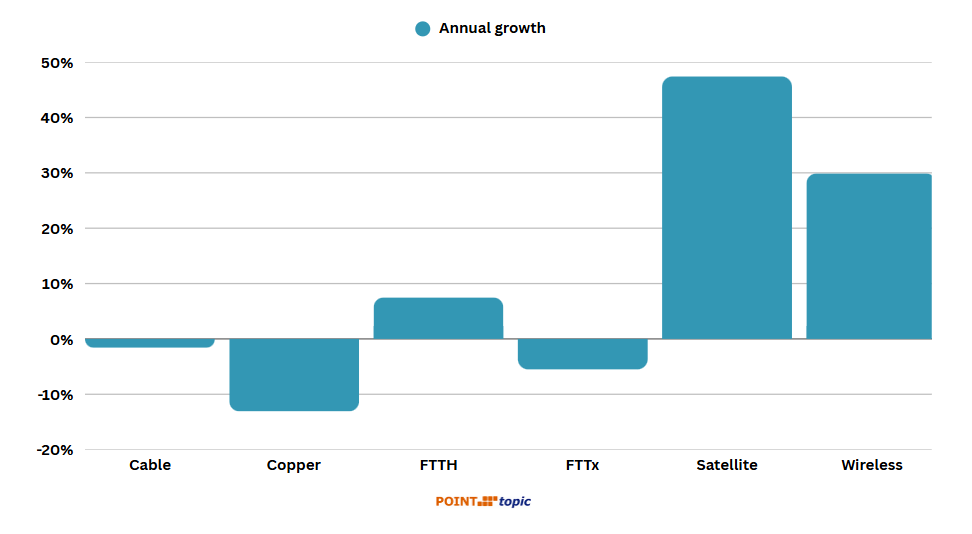

Year-on-year, FTTH/B connections grew by 7.5%. Satellite and FWA saw an even higher annual growth (47.4% and 29.9% respectively). Satellite broadband growth was mainly driven by Starlink, although it was significantly slower than in Q4 2024.

LEO satellite broadband competition intensifies, with Amazon's Project Kuiper preparing for launch by the end of 2025, potentially driving down costs and expanding connectivity.

Fixed Wireless Access (FWA) adoption accelerates, notably in the US and India, driven by aggressive investments from Reliance, Bharti, T-Mobile, Verizon and AT&T, and reshaping market dynamics, especially in rural areas.

Industry consolidation is gaining momentum with potential major deals, such as Charter’s merger with Cox in the US and potential SFR’s asset carve-up among French telecom giants Orange, Bouygues, and Iliad.

Emerging markets, particularly Sub-Saharan Africa, represent substantial growth potential, with significant investments targeting broadband infrastructure expansion.

[1] Whenever we refer to ‘broadband’ in this report, we mean fixed broadband. Also, ‘subscriptions’ and ‘connections’ are used interchangeably.

[2] It is possible there will be restatements in the coming quarter/s and single period data should be viewed in that light. Decline in some markets can be due to changes in methodology used by national regulatory authorities.

Global and regional trends in broadband subscriber growth

In Q1 2025, the global fixed broadband subscriber figure grew by 1.21%, exceeding 1.52 billion. The growth rate has recovered from the previous quarter but the overall trend is the slowing growth (Figure 1 and Table 1). This is natural given that fixed broadband penetration rates are going up, though at different rates across various regions and countries.

Table 1. Global broadband subscribers and quarterly growth rates. Source – Point Topic.

South and East Asia continues to claim the largest share of global fixed broadband subscribers, having increased it slightly in Q1 2025 to 50.8%. As the quarterly growth in China, the largest market of the region[1], was double of that in Q4 2024 (1.23% compared to 0.6%), the region’s share of fixed broadband subscriber net adds shot up from 50.4% in the previous quarter to 62.6% in Q1 2025 (Table 2 and Figure 2).

Other regions saw their net adds shares decline, with an exception of Asia-Pacific and Western Europe. The large markets of Indonesia and the Philippines recorded healthy growth rates in the former, while Italy saw a recovery from the previous quarter’s slump and Spain more than doubled its quarterly growth in the latter. North America saw a particularly large drop in the net adds share (4.4% this quarter compared to 11% in Q4 2024), as we recorded a much slower growth in the US, with satellite broadband subscriber rise much more modest compared to the last three months of 2024. In Canada, the growth was much slower due to the removal of 80K subscribers from their books by Bell.

[1] Although we use them in our reports, we cannot vouch for the country’s officially reported broadband subscriber figures which suggest household penetration well over 100%.

Table 2. Share of fixed broadband subscribers and trends in net adds by region. Source – Point Topic.

Broadband penetration among population is one of the factors affecting growth rates, as illustrated by the Middle East and Africa which remains at the bottom right corner of the penetration – growth chart (Figure 3), signifying the lowest penetration (9.2%) and the highest growth rate (2%). The region retains a good growth potential. The Global Private Capital Alliance (GPCA) reports that since 2023, infrastructure investment in Africa has been a major focus for private capital, with digital infrastructure (including fibre and data centres) representing around 25% of deal value, and infrastructure deals making up 42% of private capital deployed across the continent.

South and East Asia, Latin America, Asia-Pacific and Eastern Europe are in the centre in terms of broadband penetration but the former two regions experienced much higher quarterly growth in Q1 2025 (1.5% and 1.6% compared to 0.8% and 0.7% respectively), driven by youthful economies and populations. There is still a lot of potential for additional broadband connections in these regions.

Western Europe and North America are in the top left corner of the chart, with high penetration meaning modest growth and a decline in some markets, especially in Scandinavia and the likes of the UK and Switzerland.

Diminishing growth potential in these regions has led to a wave of mergers, acquisitions, and strategic partnerships. In Europe, consolidation is spurred by financial stress experienced by smaller players and a strategic shift towards centralized infrastructure investment. French telecoms giants Orange, Bouygues, and Iliad (Free) are in preliminary talks about a potential carve‑up of another key player, SFR. This would likely involve splitting SFR’s assets between these buyers to navigate regulatory scrutiny on consolidation.

In the US, cable giant Charter announced a $34.5 billion merger with Cox Communications, which is seen as a response to cord-cutting trends and competitive pressure from streaming and mobile providers. Other cable providers in North America are also under increasing pressure, with global cable broadband connections declining.

Country and technology trends in broadband subscriber growth

In Q1 2025, we registered the highest broadband subscriber growth rates mainly in the developing countries and least saturated broadband markets (Figure 4), with the growth sometimes coming from a very low base. Large markets of India, Vietnam, Philippines, as well as mature markets of Spain and Luxembourg also recorded healthy growth.

Looking at the largest twenty broadband markets, all except the UK saw fixed broadband subscribers grow in Q1 2025 (Figure 5). The UK saw a 0.3% churn, as the FTTP growth was not sufficient to offset the decline in DSL, FTTx and cable broadband connections. India was again at the top of this particular group, with a 4.7% quarterly growth, continuing to show huge growth potential due to the low fixed broadband penetration and the fast growing economy.

In eight of the twenty largest fixed broadband markets the growth in Q1 2025 was higher than in the previous quarter. Italy has recovered from a drop in subscriptions in the previous quarter.

Technology trends

Fibre continues to be the dominant broadband technology, and its market share has expanded further. Between Q4 2024 and Q1 2025, the share of FTTH/B in the total fixed broadband subscriptions went up by 0.42% and stood at 72.34%. Broadband connections based on cable, copper and FTTx technologies saw their market shares shrink further. Copper (ADSL) and part copper (FTTx) now have a combined market share of just above 10%. Satellite and wireless (FWA) broadband connections expanded their market shares to 0.46% and 2.67% respectively.

Table 3. Changes in broadband technology market shares. Source – Point Topic.

Among the markets with at least 0.5 million fibre broadband connections, we recorded the highest FTTH/B growth rates in Algeria (13.5%) and South Africa (12.8%) (Figure 6). Dominated by the developing economies, this ranking also contains mature markets of Belgium and the UK, with both of these countries embarking on FTTP rollout relatively late compared to some other advanced economies. Only 35% of all fixed broadband subscribers in the UK and 12% in Belgium are on FTTH/B broadband plans.

Globally, healthy quarterly FTTH/B growth rates were spread around the world, with the less advanced economies and more youthful fibre markets generally exhibiting higher growth (Figure 7).

In 12 months to the end of Q1 2025, the number of copper lines saw another decline (-13.1%), while FTTH/B connections grew by 7.5%. The decline in cable (HFC) broadband subscribers accelerated to -1.6%, while FTTx dropped by 5.5% (Figure 8). In the US, Comcast, the largest cable broadband provider, reported an even more significant churn than in the previous quarter, driven by competitive pressure from FWA providers, dissatisfaction over pricing and customer service, and broader shifts in consumer behaviour. Large market players T-Mobile, AT&T and Verizon offer fixed wireless broadband and are continuing to enjoy healthy growth in FWA subscribers.

In the satellite broadband segment, subscribers increased by 47.4% year-on-year, mainly due to the growing Starlink customer base that reached just over 5 million. The quarterly growth in Starlink subscriptions, however, was significantly lower compared to Q4 2024 (10% versus 32%). Saturation in mature markets, capacity and infrastructure constraints, and pricing/regulatory hurdles in some regions are partly to blame.

Figure 9 provides our estimated figures of Starlink subscribers in the largest 20 markets. The US continues to be the largest market with over 2 million subscribers. Brazil, Canada, Australia and Mexico are also in the top five, being large territories with vast remote areas where traditional broadband infrastructure is limited.

In this area, recent developments include significant investments in LEO satellite broadband technology beyond Starlink. Amazon’s Project Kuiper is progressing with plans to launch its first commercial satellites by the end of 2025. This could disrupt the satellite broadband segment, intensifying competition and potentially driving down prices. This could accelerate satellite broadband subscriber growth further, particularly in regions where terrestrial broadband infrastructure remains economically unviable.

Wireless broadband (mainly FWA, 5G FWA and LTE fixed) connections also continued to grow – they went up by 29.9% year-on-year, as significant growth in India and healthy increase in the US continued (32% and 7.6% respectively). We expect this trend to persist due to demand for fast connectivity in remote and underserved areas where legacy copper networks are expensive to maintain, and fibre deployment is not feasible.

Recent industry announcements in the US, particularly Verizon and AT&T’s increased investment in 5G FWA technology, suggest even greater momentum ahead. Both telecom giants are expanding their service footprints and marketing it aggressively, leveraging FWA’s ease of deployment and scalability compared to traditional fibre networks. This could further increase FWA market share in North America, particularly in suburban and rural communities. Likewise, Reliance and Bharti are driving FWA growth in India which has a huge potential market.

You can access the data used in this report by subscribing to our Global Broadband Statistics service.

Comments