Q2 2025 UK ISP and network supplier metrics - a market overview

- Veronica Speiser

- Aug 20, 2025

- 8 min read

UK Broadband Levels Off, Openreach and CityFibre Push Ahead

In summary

Total Q2 2025 FTTB/H/P, FTTC, DOCSIS 3.1, DSL, FWA and satellite retail and wholesale connections saw a very slight decrease during the quarter and stood at an estimated 28.91m, down from 28.92m q-o-q and 28.98m in the previous year.

The fixed broadband market saw -14k net broadband subscriber losses compared to ~88k net losses in Q1 2025, showing the market has firmly reached the saturation point.

Our data for Q2 2025 puts full fibre coverage at 77.8% of the UK total premises and 11.03m full fibre connections.

Openreach passed an additional 1.1m premises, bringing its total footprint to 19.1m premises, including 5.2m in rural areas.

Openreach saw a record 566k full fibre net additions, bringing its FTTP subscriber base to 7.09m; BT’s Consumer division saw positive growth again for the second consecutive quarter with 11k net broadband additions to reach 8.22m (excluding its Business segment with an estimated 582k connections).

CityFibre’s connections have increased by 69k to reach 650k during the quarter, with an overall penetration rate of 16%; however, in its most mature markets, take-up rates are around 40%.

CityFibre announced on 14 July that it secured £2.3bn in an additional round of funding; this facility will be used to finance the company’s M&A pipeline and cement its position as the sector consolidator.

Independent (or Altnet) providers[1] continued to focus on subscriber take-up and saw ~205k net additions from ~169k additions in the previous quarter.

We estimated Altnets total consumer broadband FTTB/H/P subscriber base reached 2.96m, up 41% year-on-year.

Retail (consumer and business) sector

Q2 2025 saw a loss in total consumer and business fixed connections to reach 28.91m; DSL connections dropped by 12% totalling 1.47m, FTTC reduced by 5% reaching a total of 11.10m, with FTTB/H/P lines picking up the slack with an 8% increase in uptake, totalling 11.03m (Figure 1).

Figure 1: Retail broadband connections by technology, Q2 2024 – Q2 2025

BT’s Consumer division (which includes business) recovered in Q2 with a gain of 11k net additions compared to the previous quarter’s gain of 4k subscribers; its FTTP base added 212k FTTP connections to reach 3.66m, of which Consumer 3.4m and Business 0.26m, and an increase of 32% year-on-year.

For the other major ISPs, Vodafone again saw strong gains with ~44k broadband net additions; with Virgin Media O2 (VMO2) had a tough quarter reporting -51k losses, followed by Sky’s estimated decrease of -12k connections, and TalkTalk saw another quarter of losses of around -20k connections, although not nearly as significant in previous quarters.

Despite TalkTalk’s continued battle with economic headwinds, it announced on 25 July that it received £100m of new funding facilities from shareholders. The funding will focus on its PXC wholesale business with a reinvigorated focus on its TalkTalk consumer business with a return to a more proactive approach to new customer acquisition, including a new and differentiated product offering focused on in-home WiFi coverage, delivered over a new and significantly enhanced customer service platform.

VMO2 continued to struggle with the Altnets competitive pricing strategies and stated that it is feeling the impact of the One-Touch Switching process as its broadband customer base fell -1.17% year-on-year with a reported -51,400 losses in the quarter.

Retail Business connections reached an estimated 1.96m at the close of the quarter, up slightly from 1.87m in the previous quarter. FTTC connections dropped to ~577k from ~737k in Q1 2025. FTTP connections increased to ~950k from ~686k (Figure 2).

Figure 2: Retail business broadband connections by technology, as of Q2 2025

BT’s Business division seems to be stabilising as it reported a loss of 6k connections, bringing its total to 582k; VMO2 also reported a loss in its B2B segment, especially in the lower value areas.

In May, VMO2 announced the creation of a new B2B company, combining VMO2 Business and Daisy Group, with an ownership split of 70% Virgin Media O2 and 30% Daisy Group, with both sides contributing debt into the entity, and is expected to close in H2 2025. VMO2 will be contributing all of its retail mobile and fixed B2B businesses to the entity, but will retain its wholesale businesses along with its network assets. The new entity will act as a reseller of VMO2’s (along with other wholesale providers’) services.

The O2 Daisy merger completed on 1 August, and the 2025 financial year guidance will be bolstered by the revenue generation of the integrated business operations (around an additional £125m to Group revenue in 2025), along with the market share gains of the giffgaff broadband launch over nexfibre; the 2026 outlook is more challenging as the fixed line market stagnates and VMO2 remains subject to how the Altnet consolidations pan out over the next half year.

Retail and business FTTB/H/P connections reached an estimated 11.03m at the end of Q2 2025. Figure 3 below represents the growth in full fibre connections (for the major ISPs and combined Altnets) over the past year.

Figure 3: Top 5 retail broadband providers and Altnets full fibre connections, Q2 2024 – Q2 2025

We estimate BT’s Consumer segment to have reached just under 18% take-up where Openreach’s footprint was present.

BT continues to pivot its Consumer segments strategy as it shifts its focus from “New EE” retail brand (launched in Oct. 2023) to its overlooked BT and Plusnet brands.

With New EE uptake falling short, BT is investing in targeted campaigns to capture value-driven consumers for its Plusnet brand. Plusnet’s recent customer satisfaction award wins (USwitch, Broadband Genie) strengthen its positioning as a budget-friendly ISP, particularly in regions where Altnets lure customers with aggressive fibre pricing and incentives like no mid-contract rises or contract buyouts. Its H1 FY26 results covering up to end-September should see further positive gains for BT as the end of August and September see the start of university tenancy agreements.

VMO2 has seen incremental growth in its FTTP base to reach an estimated 829k subscribers, and we estimate its full fibre penetration rate to be ~12% where available.

VMO2 continued to struggle with overall subscriber losses (~50k) due to Altnet overbuild, One-Touch Switching, which has deprived Virgin of exclusive retention offers to keep churn rates at bay, and seasonal price rises added further revenue drag to a loss of around -1% during the quarter.

Altnets have proved to be a manageable threat to Openreach so far, less so to VMO2 as above. We estimate the total number of Altnet FTTP connections to have reached 2.97m, up from 2.76m in the previous quarter. See Table 1 for year-on-year take-up rates for selected Altnets.

Table 1. Selected Altnet suppliers and retail ISPs full fibre penetration rates, Q2 2024 and Q2 2025

Retail new subscriber entry-level pricing trends for full fibre / gigabit-capable services

Overall, ISPs will all be in the same predicament as they will all be operating in a dwindling market, with most consumers continuing to be more budget-conscious and opting to stay on a speed tier that already suits their needs without seeing the necessity to upgrade to the more costly gigabit-capable or higher speed tiers.

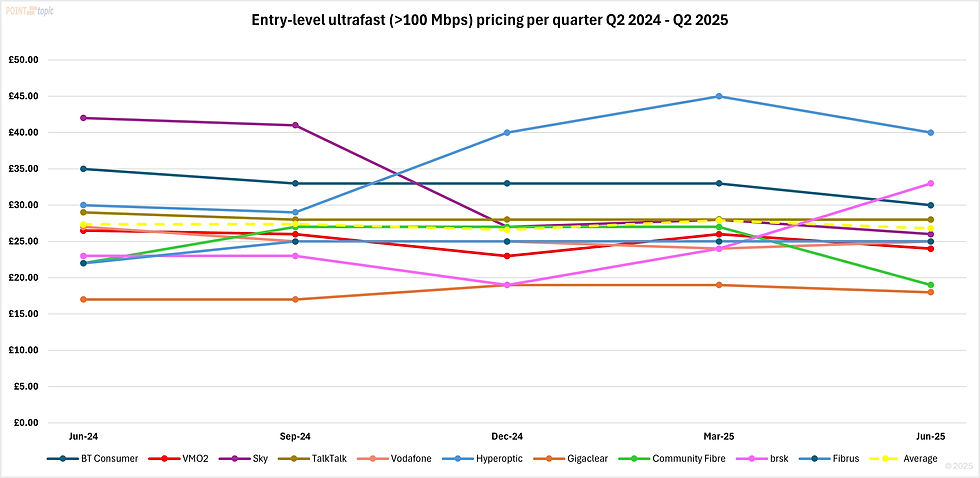

In terms of entry-level ultrafast (full fibre, with speeds greater than 100 Mbps) pricing, tariffs remained relatively stable and decreased slightly by 4% to reach an average of £26.80 per month from £27.90 in Q1 (Figure 4).

In addition to the major suppliers, we tracked 5 Altnet providers ranging from the larger national players (Hyperoptic and Gigaclear) to London-focused urban supplier Community Fibre, and regional ISPs Fibrus and brsk. Gigaclear continued to be the cheapest major Altnet offering symmetric 200 Mbps entry-level packages for £18.00 per month.

Figure 4: Retail ISPs entry-level ultrafast pricing, Q2 2024 – Q2 2025

Hyperoptic remained the most expensive at £40.00 per month for its symmetrical 150 Mbps entry-level package as it seeks to increase its ARPUs, focus on uptake and reduce expansion costs.

brsk's symmetrical 150 Mbps package came in at £33.00 per month, followed by BT’s 100 / 30 Mbps package at £29.99 per month.

TalkTalk is remaining competitively priced at £28.00 for 152 / 30 Mbps full fibre, followed by Sky’s 100 / 19 Mbps package costing £26.00, next came Vodafone’s 150 / 75 Mbps tier costing £25.00, and Fibrus’ 106 / 31 Mbps £24.99 monthly package, and Community Fibre rivalled Gigaclear with its symmetrical 100 Mbps package costing £19.00 per month.

Infrastructure (wholesale) sector

Total Q2 2025 FTTB/H/P, FTTC, DOCSIS 3.1, DSL, FWA and satellite wholesale connections saw a very slight decrease during the quarter and stood at an estimated 28.91m, down from 28.92m q-o-q and 28.98m in the previous year.

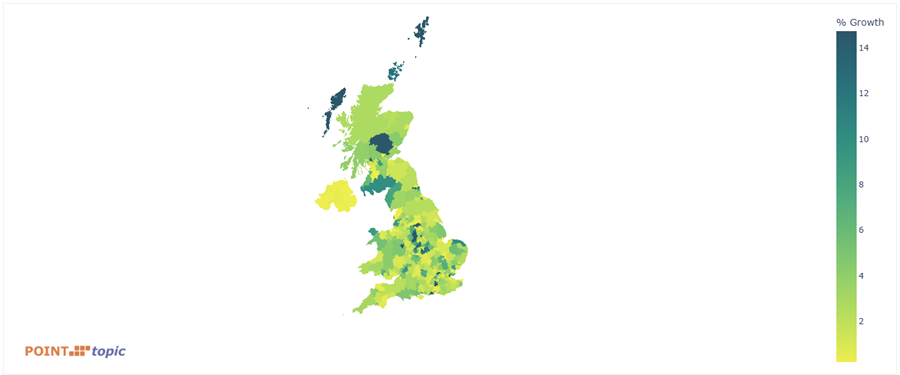

In our latest UK broadband availability report, at the end of Q2 2025, FTTP coverage was 77.8% of the UK premises, compared to 75.8% at the end of Q1 2025. The number of FTTP premises went up 15.3% y-o-y.

10.9m premises had access to two or more FTTP networks (32.6% of all UK premises). Just over 1.75m premises were covered by 3+ fibre networks.

Openreach passed more than 1m premises with FTTP for a sixth consecutive quarter, putting its build rate at an average of 81k per week (on track to achieve up to 5m this fiscal year), and its total FTTP footprint reached more than 19m premises, of which 5.2m are in rural locations.

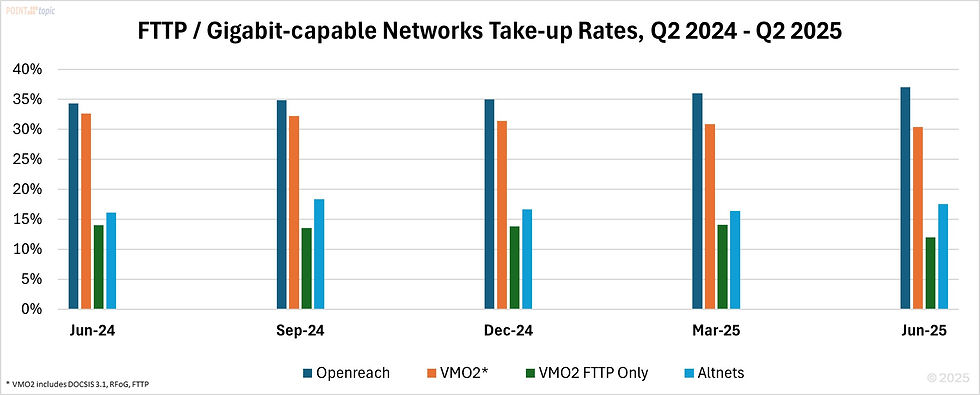

Openreach’s FTTP connections increased by 566k q-o-q to reach 7.09m with a take-up rate of 37% (Figure 5).

Figure 5: Openreach ultrafast coverage, connections and penetration rates, Q2 2024 – Q2 2025

Openreach will have welcomed the news of TalkTalk’s funding announcement (see above) as it is a significant reseller however, the latter’s reinvigorated approach to secure new consumer connections will place further competitive pressure on BT’s consumer division. Openreach also faces further losses with the launch of Sky’s faster speed tier services over CityFibre’s network, with impacts of the launch to be felt closer to the end of 2025.

Openreach did secure a major Altnet agreement with MDU-focused national Altnet supplier Hyperoptic as the latter announced on 10 June that it would extend availability of its service to at least an additional one million homes using Openreach’s network starting in early 2026.

VMO2’s combined full fibre footprint reached 6.9m premises through a combination of its existing fibre footprint, progress in the fibre upgrade activity, and slowed down nexfibre deployments (Figure 6).

Figure 6: Virgin Media O2’s combined FTTP network deployments, Q2 2024 – Q2 2025

At the end of July, Telefónica confirmed that it will be scrapping its previously planned wholesale network rival to Openreach – NetCo – a subsidiary of Liberty Global and Telefónica’s VMO2 that would form a national fixed operator to take over VMO2’s HFC and fibre network as a wholesaler, with VMO2 becoming an anchor tenant of the entity. Telefónica confirmed that due to the company’s ongoing debt burden, it wouldn’t be pursuing the creation of the entity.

Telefónica’s ongoing review has also resulted in the slowdown of VMO2’s full fibre rollout of overlaying its cable network with FTTP, along with nexfibre’s. nexfibre’s network expanded by 115k premises during the quarter, down from 165k in Q1, and 486k in Q4 2024.

Figure 7 provides a flavour of the year-on-year take up rates to FTTP or gigabit-capable networks, with Openreach dominating the sector in terms of full fibre penetration. VMO2’s DOCSIS 3.1 technology, which for several years boasted higher speed advantages, has been steadily receding as more affordable and faster packages have become readily available due to overbuild by the Altnets.

Figure 9: FTTP / Gigabit-capable broadband take-up rates, Q2 2024 – Q2 2025

Altnets FTTP connections increased by 21.3% during the quarter, with 205k net additions.

Openreach will see the broadband market stabilising over the next year as CityFibre’s round of funding will see it consolidating the Altnets to a wholesale-based model, with any further organic network expansions being reduced as Openreach nears its 25m premises passed target by 2026.

[1] Point Topic tracks the quarterly key metrics of 106 Altnet network suppliers and ISPs, the figures included here are based on company reports, market resources and our estimates, where necessary.

Comments