Research Round-up November 2025

- Veronica Speiser

- Dec 1, 2025

- 8 min read

Key publications of the month:

Q3 2025 UK ISP and network supplier metrics - FTTP Takes the Lead: Full Fibre Connections Overtake FTTC

Summary

The UK broadband market regained momentum in Q3 2025, adding 64k subscribers and returning to growth across a total base of 28.94m lines. Full fibre (FTTP) adoption surged ahead at its fastest rate since nationwide rollouts began, reaching 11.56m connections and overtaking FTTC for the first time, with the latter decreasing to 10.60m. Full fibre coverage reached 79.5% of premises, with multi-network overbuild increasing sharply, and FTTP take-up, while strong, is expected to stabilise over the next year as the early-mover surge eases.

Other key points:

Total Q3 2025 FTTB/H/P, FTTC, DOCSIS 3.1, DSL, FWA and satellite retail and wholesale connections saw a slight return to growth during the quarter and stood at an estimated 28.94m, up from 28.88m q-o-q and down from 29.01m in the previous year.

Full fibre connections reached an estimated 11.56m up 7.9% q-o-q, and for the first time FTTP connections overtook FTTC subscriber lines with the latter decreasing to 10.60m.

The fixed broadband market rebounded with 64k net additions in Q3, reversing the ~25k losses in Q2. However, this seasonal lift is short-lived, with the market expected to return to flat or negative growth in line with the overall trend for 2025.

Openreach saw 551k full fibre net additions, bringing its FTTP subscriber base to 7.65m; BT’s Consumer division saw growth again for the second consecutive quarter with 1k net broadband additions to reach 8.21m (excluding its Business segment with an estimated 576k connections).

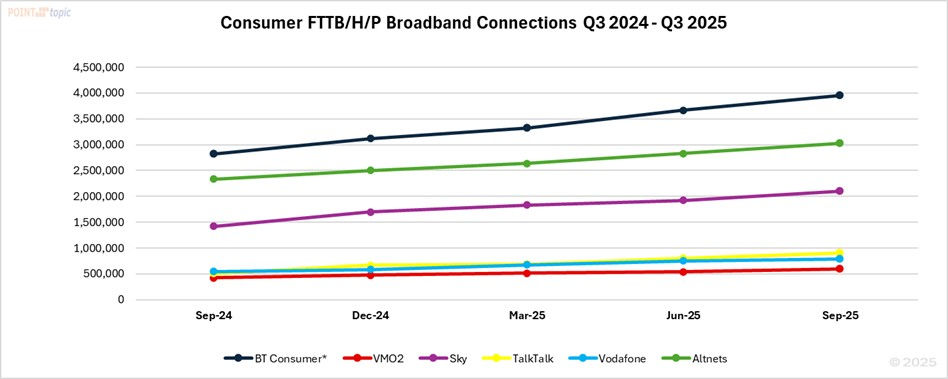

Independent (or Altnet) providers[1] continued to focus on subscriber take-up and saw 193k net additions from 190k additions in the previous quarter, with a total consumer broadband FTTB/H/P subscriber base reached 3.02m, up 29% year-on-year.

Retail (consumer and business) sector

Q3 2025 saw modest gains in total consumer and business fixed connections to reach 28.94m; DSL connections dropped by 2.5% totalling 1.43m, FTTC (including G.Fast) reduced by 6.7% reaching a total of 10.60m, with FTTB/H/P lines increased 7.9% and overtook FTTC connections for the first time, totalling 11.56m (Figure 1).

BT’s Consumer division (we include BT’s Business segment in our reporting) remained positive (just) in Q3 with a gain of 1k net additions (with a total base of 8.78m) compared to the previous quarter’s gain of 11k subscribers; its FTTP base added 284k FTTP connections to reach 3.95m, of which Consumer 3.7m and Business 0.27m, and an increase of 32% year-on-year and representing 45% of its subscriber base.

For the other major ISPs, Vodafone again saw strong gains with 50k broadband net additions; with Virgin Media O2 (VMO2) reporting 26k losses, followed by Sky’s estimated decrease of 10k connections, and TalkTalk saw another quarter of monumental losses of around 120k connections.

VMO2 completed the acquisition of the small business broadband provider Daisy (branded O2 Daisy) and reported Daisy’s 87k business broadband customer base under its consumer segment.

BT added 284k FTTP subscribers in the quarter, bringing its retail full fibre base to 3.67m, up 32% y-o-y, comprising 45% of the total base. Its converged base continued to grow, up to 25.9% (H1 FY25: 23.1%) of all broadband and mobile customers now taking both services (Figure 2).

VMO2 saw a 10% growth in its FTTP base, reaching an estimated 596k subscribers, and we estimate its full fibre penetration rate to be 8% where available. Historically, August and September have returned stronger operational KPIs for VMO2; however, despite the acquisition of Daisy’s base, the underlying losses for Q3 remain in line with the previous quarter’s lacklustre performance for the operator.

CityFibre saw the largest gains (108k additions) as a focused wholesale consolidator, with Sky being fully onboarded and offering services in non-Openreach footprint areas.

Altnets remain a manageable threat to Openreach with the latter expanding its FTTP footprint at pace it should navigate the tricky Altnet consolidation shake-up steadily. We estimate the total number of Altnet FTTP connections to have reached 3.02m up from 2.82m in the previous quarter. See Table 1 for year-on-year take-up rates for selected Altnets.

Figure 3 provides a flavour of the year-on-year take-up rates for FTTP or gigabit-capable networks, with Openreach dominating the sector in terms of full fibre penetration. VMO2’s DOCSIS 3.1 technology, which for several years boasted higher speed advantages, has been steadily declining (down to 30% in Q3 and expected to drop below this in the next two quarters) as more affordable and faster packages have become readily available due to overbuild by the Altnets.

Altnets FTTP connections increased by 6.8% during the quarter, with 193k net additions with a total base of 3.02m.

[1] Point Topic tracks the quarterly key metrics of 106 Altnet network suppliers and ISPs, the figures included here are based on company reports, market resources and our estimates, where necessary.

Read the complete article in our free analysis here and UK Plus subscribers can now access our quarterly Data Windows.

Explore insights and trends on pricing and ISP key metrics from 2020 to the present with our quarterly downloadable Datasets.

Key November telecoms sector news

BT Group News

3 November – BT completes sale of its datacentre business in Ireland to Equinix.

6 November – BT Group and Starlink pave the way for high-speed home broadband in the UK’s hardest-to-reach places. The collaboration – a first in the UK and one of the first globally – will see BT Group offer ultrafast, low-latency satellite connectivity to customers in rural and remote areas where traditional fixed-line infrastructure is economically unviable or geographically challenging to build. The service is expected to be available to customers in the latter half of 2026.

6 November – BT published group results for the half year to 30 September 2025, with highlights included in our Q3 metrics report above.

6 November – According to news reports, Openreach says it will scrap the final phase of its plan to make fibre broadband available to 30 million UK homes by 2030 if the regulator goes ahead with its draft proposal of the Telecoms Access Review (TAR), which covers the next five years.

12 November – Openreach published: GEN102/25 Special Offer on connection charge for WLR migrations to SOGEA. The briefing is to inform all CPs about the launch of a Special Offer discounting SOGEA connection prices for migrations from WLR to support CPs migrating off the PSTN ahead of withdrawal in January 2027. This offer launches on 1 January 2026 and ends 30 June 2026.

20 November – Openreach announced its GEN107/25 Extension of special offer: Ethernet Access Direct (EAD) 1000Mb Local Access alternative pricing for the UK excluding CLA and HNR areas.

24 November – More than half a million EE customers across the UK have received a boost to their mobile connectivity in time for Christmas, after the operator gifted 5G+ access to customers with compatible smartphones.

As part of its latest network rollout, 20 new towns and cities are now also live with 5G+ ahead of the busy festive season – benefiting a further 1.6m people.

26 November – Openreach announced GEN110/25 Exchange Exit Update: Deddington Exchange Exit.

27 November – Openreach published GEN112/25 LLU and Access Locate Power Price Update. From 1 January 2026, the price of power usage per kWh for all comingling products used for LLU, Access Locate and Access Locate Plus will decrease from £0.2327 to £0.2154.

From 1 April 2026, the price for power usage per kWh will increase from £0.2154 to £0.2580. Any power used from these dates onwards will be charged at the revised rate until further notice.

27 November – Openreach published NGA2018/25 XGS-PON Pilot Pricing for new FTTP bandwidths. Openreach is piloting XGS-PON FTTP bandwidths from March 2026 onwards in select areas. it notified Pilot pricing for two of these bandwidths today, with more to follow at a later date.

27 November – Openreach announced NGA2019/25 Equinox Legacy Regrade Amendment – waiver of order deadline. Openreach is making it easier for Communications Providers (CPs) to continue migrating end customers away from WLR ahead of the PSTN closure.

The Equinox Legacy Regrades Amendment sets out a process for transfers of existing WLR services to Openreach’s SOGEA service and SOTAP for Analogue service without impacting the calculation of Fibre Only performance in Equinox (see briefing NGA2010/24 for full details). The Equinox Legacy Regrades Amendment is optional and remains open for CPs to sign.

It is issuing a waiver for those CPs that have already signed the Equinox Legacy Regrades Amendment. This means CPs who have already signed the amendment – and any who sign it in future – can continue to exclude certain qualifying WLR migrations from the calculation of Fibre Only performance in Equinox until PSTN closure is complete in January 2027.

Virgin Media O2 (VMO2) News

3 November – Virgin Media O2 blocks 1 billion scam text messages on its mobile network.

6 November – Virgin Media gigabit broadband is now available to 6,000 more homes in Widnes for the first time.

11 November – Virgin Media enhances its cybersecurity offering with new ‘Identity Protection’ feature.

18 November – Virgin Media gigabit broadband is now available to 6,000 more homes in Ripon for the first time.

20 November – Virgin Media O2 optimises connectivity on over 40 motorways and A roads in boost to Britain’s EV future.

26 November – O2 brings faster, more reliable 5G to Norfolk.

CityFibre (CF) News

19 November – CF announced that from today, over 80,000 premises across Hull and East Riding can make the most of full fibre broadband on CityFibre’s 10Gb XGS-PON network and choose from household names including Sky, Vodafone and TalkTalk alongside award-winning providers such as 4th Utility, toob and Cuckoo Broadband. In total, residents of the area can choose from over 30 retail ISPs using CF's network.

Independent Operators (Altnets) News

6 November – giffgaff announced it had launched its full fibre broadband service in Chester.

13 November – Netomnia published its Q3 results and reported that its serviceable premises increased by 241k to reach 2.8m premises, with subscribers increasing by 54k to reach 396k.

24 November – Thinkbroadband reported that Scottish broadband altnet GoFibre has announced it has completed the Project Gigabit rollout across Teesdale in County Durham. This contract with around £6.6m was awarded to Borderlink/GoFibre in September 2022 and includes over 4,000 Project Gigabit funded premises across 8,100 total premises now able to receive full fibre broadband services. A very small number of premises were removed from the contract earlier this month.

Other News

4 November – The Scottish Government published an article noting that its Open Market Review and updated broadband checker are improving broadband accessibility and noted that more than 93,000 premises have been passed as part of its R100 programme.

6 November – DSIT launched its Public Switched Telephone Network charter which sets out a voluntary agreement between the government and communication providers to protect vulnerable people when they are moved onto digital services.

13 November – DSIT published its Bulletin: BDUK delivery performance, quarterly: April 2025 to Sept 2025. Its headline findings noted that it estimates that BDUK interventions delivered 44,000 premises with gigabit-capable coverage between 1 April 2025 and 30 June 2025 (Q1 2025/26) and 36,200 between 1 July 2025 and 30 September 2025 (Q2 2025/26, latest quarter). A cumulative estimate of 1,307,200 premises have received gigabit-capable coverage by BDUK’s gigabit programmes since their inception.

14 November – TOTSCo approaches 2 million OTS switches according to a news report by Thinkbroadband.

19 November – Around 780,000 homes in Northern Ireland have access to full-fibre broadband – the highest proportion of all the UK nations – according to Ofcom’s latest annual Connected Nations report.

Please get in touch if you would like to find out more about UK Plus or particular publications.

Comments