European Broadband Operators and Tariffs Benchmark Report, Q2 2025

- Veronica Speiser

- Sep 3, 2025

- 10 min read

Introduction

Point Topic tracks the quarterly changes in the standalone and bundled broadband tariffs provided by European[1] fixed line residential and business operators. This report presents the latest tariff benchmarks at the end of June 2025. To put them into perspective, we are comparing the trends to March 2025.

The complete tariff data is available within Point Topic’s European Broadband Statistics subscription service. We provide access to the raw data, as well as charts and tables for the tariffs offered.

European Broadband Market – Q2 2025 Highlights

Tariff Tracking Scope

1,129 residential and 760 business broadband tariffs tracked across 31 European countries.

Overall Market Speeds & Tariffs

Average downstream (all technologies): 725 Mbps (up 13.8% from 637 Mbps in Q1).

Driven by XGS-PON fibre upgrades and competitive speed tier boosts.

Ultrafast offers expanding:

- 355 tariffs ≥1 Gbps in Q2 (vs 327 in Q1).

- 85 packages in 2–10 Gbps range (vs 71 in Q1, 64 in Q4 2024).

Cost per Mbps (residential): down from $0.11 PPP to $0.10 PPP.

- Copper: $2.22 PPP per Mbps (down from $2.28).

- Fibre & cable far cheaper per Mbps.

Copper-Based Broadband

Continued decline: 43 packages in June vs. 61 in March 2025.

Operators accelerating switch-offs and “stop-sells” in high fibre areas.

Rising OPEX per line makes copper less viable.

ISPs discouraging copper uptake with fewer choices, higher costs, and slower speeds.

Average price: $50 PPP.

Average speed: 23 Mbps (up slightly from 22 Mbps).

Cable Broadband (DOCSIS)

Still widely available, with new investment continuing despite fibre’s dominance.

DOCSIS 4.0 upgrades gaining traction, supported by Distributed Access Architecture (DAA).

Liberty Global & CommScope partnership:

- Virtualised DAA upgrades for VodafoneZiggo (Netherlands), Telenet/Wyre (Belgium), and Sunrise (Switzerland).

- Deployments of CommScope’s DC2182 DOCSIS 4.0 1.8GHz DAA node.

Tariff trends (Q2 2025):

- 138 cable tariffs in June (up from 134 in March).

- Average speed: 653 Mbps (+20% QoQ, from 544 Mbps).

- Average monthly price: $66 PPP (+1.5%).

Full Fibre (FTTH/B)

Take-up rates remain a challenge throughout Europe.

Key challenge: consumer apathy - many subscribers still see legacy networks as “good enough.”

Barriers include: hassle of switching, new equipment needs, and risk of losing bundled services.

FWA/mobile broadband competes strongly in Central & Eastern Europe as a cheaper, simpler alternative.

Tariff trends (Q2 2025):

Fibre remained most expensive technology: $71 PPP (up from $69 PPP).

Average speed: 815 Mbps (+12.4% from 725 Mbps).

917 fibre tariffs recorded (down from 955 in Q1), suggesting streamlining toward higher-speed tiers.

Residential broadband packages

During Q2 2025, we tracked 1,129 residential broadband tariffs across 31 European countries.

Throughout Europe, operators are accelerating copper exchange switch-offs and “stop-sells” in areas with high full fibre coverage. Network suppliers are feeling the squeeze of high OPEX costs in maintaining dwindling copper bases with an increase in per-line costs as a result. Providers continue to nudge users off legacy tiers with fewer package offerings, higher monthly list prices and slower speed tiers.

At the end of June 2025, the monthly average copper-based residential broadband tariff cost $50 PPP and as expected offered the lowest average download speed of 23 Mbps which is up slightly from the previous quarter’s 22 Mbps (Figure 1).

The progression of full fibre network coverage across Europe continues to dominate company reports and news headlines however, cable-based technologies are still largely available and continue to be invested in by some suppliers.

DOCSIS 4.0 upgrades are starting to gain momentum in Europe, especially in countries with dense cable coverage like Austria, Belgium, the Netherlands, and Switzerland due to Distributed Access Architecture (DAA) deployments by Liberty Global among others. In June, Liberty Global announced it had chosen CommScope to upgrade several networks for virtualized DAA operation in Europe. Liberty Global will upgrade the DOCSIS fixed access networks of some of its affiliates, including VodafoneZiggo in the Netherlands, Telenet (Wyre) in Belgium and Sunrise in Switzerland.

Fibre-based tariffs remained the most expensive of the technology accesses in Q2, coming in at $71 PPP up from $69 PPP in the previous quarter. The average speeds also increased by 12.4% from 725 Mbps to 815 Mbps quarter-on-quarter. For those consumers still feeling the continued sting of the cost-of-living crisis and increased inflationary costs, the lure of a more expensive yet faster broadband package is not seen as essential.

At the end of June, the average downstream bandwidth in Europe, regardless of technology, was 725 Mbps up 13.8% from 637 Mbps in the previous quarter. This is mainly due to operators optimising their XGS-PON fibre technology to boost speed tiers to keep up with the competition.

As FTTP and DOCSIS 3.1 availability across Europe is becoming more widespread, we recorded 355 residential gigabit tariffs (with downstream bandwidth of at least 900 Mbps) in Q2 2025. This is up from 327 ultrafast tariffs on offer in the previous quarter. More notable was the 19.7% increase in the number of tariffs being offered in the 2 Gbps – 10 Gbps speed range. In Q2 we recorded 85 >2 Gbps residential packages on offer compared to 71 in Q1 and 64 in Q4 2024.

Business broadband packages

Europe’s business broadband market in Q2 2025 continued to be marked by consolidation[1], strategic partnerships, and infrastructure-focused investments, however, uptake continues to trail availability. Costs remain stable for businesses, with fibre gaining momentum in speed and availability. The regulatory environment (Gigabit Infrastructure Act) and technological innovations such as AI‑driven deployment tools are poised to further catalyse business-focused broadband services.

Costs for fixed line B2B broadband services have stabilised quarter-on-quarter. The average monthly cost for business broadband services, regardless of the technology, was $142 PPP during the quarter, down from $145 PPP (Figure 2).

As would be expected, ISPs are trying to migrate or deter new consumers to take up copper-based services, especially when millions in CAPEX have been invested in upgrading to FTTP or DOCSIS 3.1 networks. Copper legacy networks are expensive to maintain, prone to more faults, and do not meet current and future legislation requirements for gigabit-capable coverage. As a result, ISPs are offering lower downstream speeds for these services with the average speed decreasing from 26 Mbps to 17 Mbps. There were 31 copper-based business tariffs recorded in Q2 down from 36 in the previous quarter.

The number of full fibre tariffs during the quarter as we recorded 646 tariffs compared to 624 in Q1. The average download speed for businesses using fibre-based connections increased by 14% (994 Mbps) in Q2 up from 739 Mbps at the end of March 2025.

The number of cable tariffs decreased from 83 cable-based packages on offer in Q1 to 68 at the end of the quarter. However, the average bandwidth being offered via cable increased by a whopping 48% quarter-on-quarter from 530 Mbps to 785 Mbps. Clearly, the larger cable operators with significant HFC networks in place, such as VodafoneZiggo in the Netherlands, Telenet (Wyre) in Belgium and Sunrise in Switzerland, are minimising their cable offerings, maximising those speed tiers, and pushing the costs onto business subscribers. However, as previously stated, these operators are investing in newer DOCSIS 4.0 technology along with upgrading some legacy networks to FTTP, so these costs will automatically be transferred to the consumer.

Regional tariffs and bandwidths

Residential broadband packages

At the regional level, average download speeds remain >500 Mbps but an imbalance in terms of average monthly subscription costs in Eastern Europe and Western Europe. There were significantly more tariffs on offer in Western European countries (953 in total) compared to Eastern Europe (176 in total). The average monthly subscription cost for Western Europe was $73 PPP compared to $55 PPP in the eastern region. Prices have dropped quarter-on-quarter by nearly 8% in Eastern Europe compared to a 3% increase in prices in Western European countries. Eastern European subscribers were also benefiting from faster average download speeds compared to their western counterparts, with speeds coming in at 817 Mbps and 704 Mbps, respectively. Figure 3 below represents the disparity between the sheer volume of tariffs available in Western Europe compared to Eastern Europe along with the varying price ranges in Western Europe compared to the eastern region.

While Western Europe wrestles with legacy infrastructure, consolidation, and higher cost structures, Eastern Europe is capitalising on a clean-slate advantage, rolling out modern full fibre networks efficiently and affordably. The EU Digital Agenda and Recovery & Resilience Facility (RRF) funds have supported fibre rollouts and rural broadband programs across countries like: Croatia, Hungary, Poland, and Slovakia.

Many of these programmes are conditioned on affordable pricing and speed minimums, especially in underserved regions. Another factor at play is that network equipment vendors such as Huawei, ZTE, and Nokia often offer favourable financing terms or partnerships in Eastern Europe, especially in markets with less geopolitical restriction. Compared to operators in Western European countries who have higher operating costs, more regulatory and planning barriers, and higher ARPU expectations, Eastern European operators have been able to offer faster, more affordable broadband and still maintain margins.

At a country level, the countries at the top end of GDP per capita remain at the top of the league by average bandwidth (Table 1). For the first time since our reporting began, all top 10 countries average downstream speeds are above 1 Gbps.

For the fourth consecutive quarter, Iceland topped the list with its average speed coming in at 3278 Mbps, followed by France’s 2799 Mbps. In the previous quarter, France was in tenth place but has moved up considerably to second. Out of the 16 full fibre packages on offer, 9 tariffs were offering speeds from 900 Mbps to 8000 Mbps. Switzerland came in third, offering average speeds of 2582 Mbps. Poland is a new entrant for this quarter, coming in fifth at 1765 Mbps on average, with Belgium coming in tenth at 1088 Mbps.

Overall, the top ten countries in terms of average downstream speeds are offering 1000+ Mbps speed tiers as the norm, demonstrating the firm shift to gigabit or multigigabit full fibre technology.

Business broadband packages

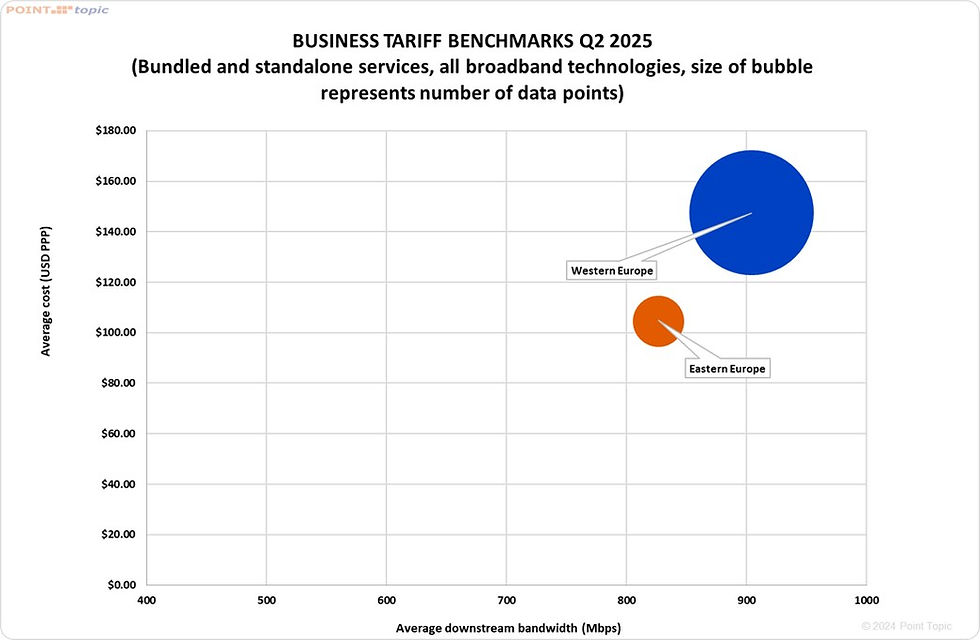

At the regional level, there were fewer disparities in the average download speed and average monthly subscription for business services in Eastern Europe and Western Europe. Like residential services, there were significantly more tariffs on offer in Western European countries (654 in total) compared to Eastern Europe (106 in total). The average monthly subscription cost for Western Europe was $148 PPP compared to $104 PPP in the eastern region. The average download speed was slightly higher in Western Europe – 904 Mbps compared to 827 Mbps in Eastern Europe.

During the quarter, Western Europe saw a 25% increase in the average speed, compared to Eastern Europe’s 26% increase. In the same period, the average subscription decreased by 2.8% in the more saturated markets of Western Europe compared to an increase of 6.5% in Eastern Europe. Figure 4 represents the disparity between the two regions in terms of the number of tariffs, costs, and speed availability.

Country ranking

We are using the three most common comparison aggregations:

The entry level tariff – typically ignores variations in bandwidth caps, time charging, actual bandwidth offered and overall availability of a tariff in the market. Best used to indicate the conditions at the low end of the market and best comparator if you are looking at the market penetration for broadband overall or a particular technology.

The median tariff – the value in the middle of the count of all values in the set. It can be skewed by unbalanced reporting or data gathering. Useful as a general indication of the country market and for inter market comparisons.

The average tariff – doesn’t represent an amount anyone actually pays, skewed by extremes in price. The best single number for comparing whole country markets when you want to understand the range of options for the consumer.

There is a difference in the relative country performance depending on which metric is used, and the variation can be significant.

The above chart (Figure 5) highlights some of the issues we have outlined above.

The relatively small spreads in Italy, Slovenia, and the Netherlands suggest that it is relatively easy to get more bandwidth, at least in terms of cost, however the entry level costs remain quite high in those countries. Belgium, Croatia, and Iceland are the most expensive markets, with the average and median costs especially high. However, they have many 400 Mbps to 1000+ Mbps tariffs on offer based on DOCSIS3.1 or full fibre technologies.

Country ranking tables

Ranking countries using the average cost of broadband subscriptions is a straightforward idea but the variation in entry level versus median and average costs can be significant. To help provide an easy way of comparing directly we have taken the PPP data on the entry level, median and average tariffs, produced rankings and then compared the variance (Table 2).

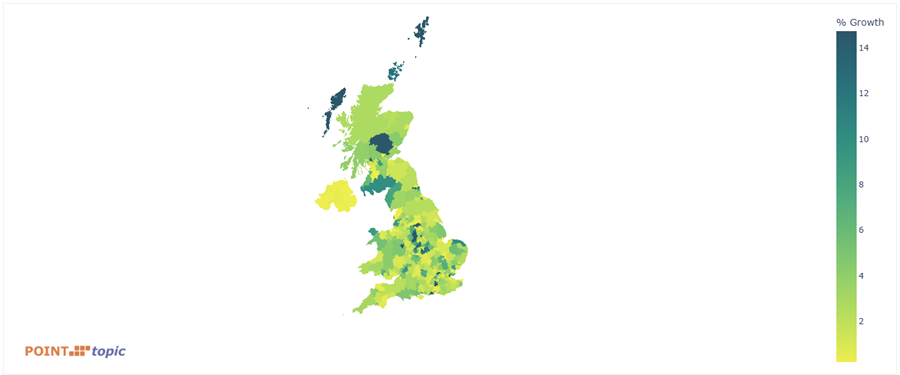

We have included a ‘variance’ column to indicate how different ranks for the different metrics are spread. So, we see that, for example, the widespread in Denmark, Italy, Latvia, Portugal and the UK (big differences in entry level, average and median tariffs) is represented by high variance of the rankings. At the other end of the scale countries such as Czech Republic, Hungary, Iceland, Norway, Poland, Romania, Slovakia, Switzerland, and the Netherlands rank rather consistently. However, it should be noted that this is only one set of metrics measuring one aspect of the broadband markets so conclusions should not be drawn in isolation.

[1] Spain’s Orane and MásMóvil deal closed in 2024, its impact carried into 2025 with the merger forming MásOrange, slimming Spain’s telecom market from four major players to three, with regulatory approval conditioned on asset divestitures; Completed in late 2024 but materialised strategically into 2025, this €2.15 billion deal merged e& (formerly Etisalat) with PPF’s telecom assets across Bulgaria, Hungary, Serbia, and Slovakia, forming a new pan-regional operator; Finalised in Q1 2025, Swisscom successfully acquired Vodafone Italia and merged it with Fastweb, creating Italy’s second-largest fixed‑line broadband operator; Completed on 31 May 2025, Vodafone UK and Three UK formed VodafoneThree, combining Vodafone and Three UK into a single operator serving around 27 - 29 million subscribers; 12 May 2025 Virgin Media Business (VMO2) and Daisy announced their plans to merge, VM O2–Daisy JV will consolidate and strengthen business offerings in the UK, expected to contribute around £125m of revenue in 2025.

The complete tariff data is available within Point Topic’s European Broadband Statistics subscription service. We provide access to the raw data, as well as charts and tables for the tariffs offered.

Comments